What Has Caused The Rise of Retail Traders in 2020?

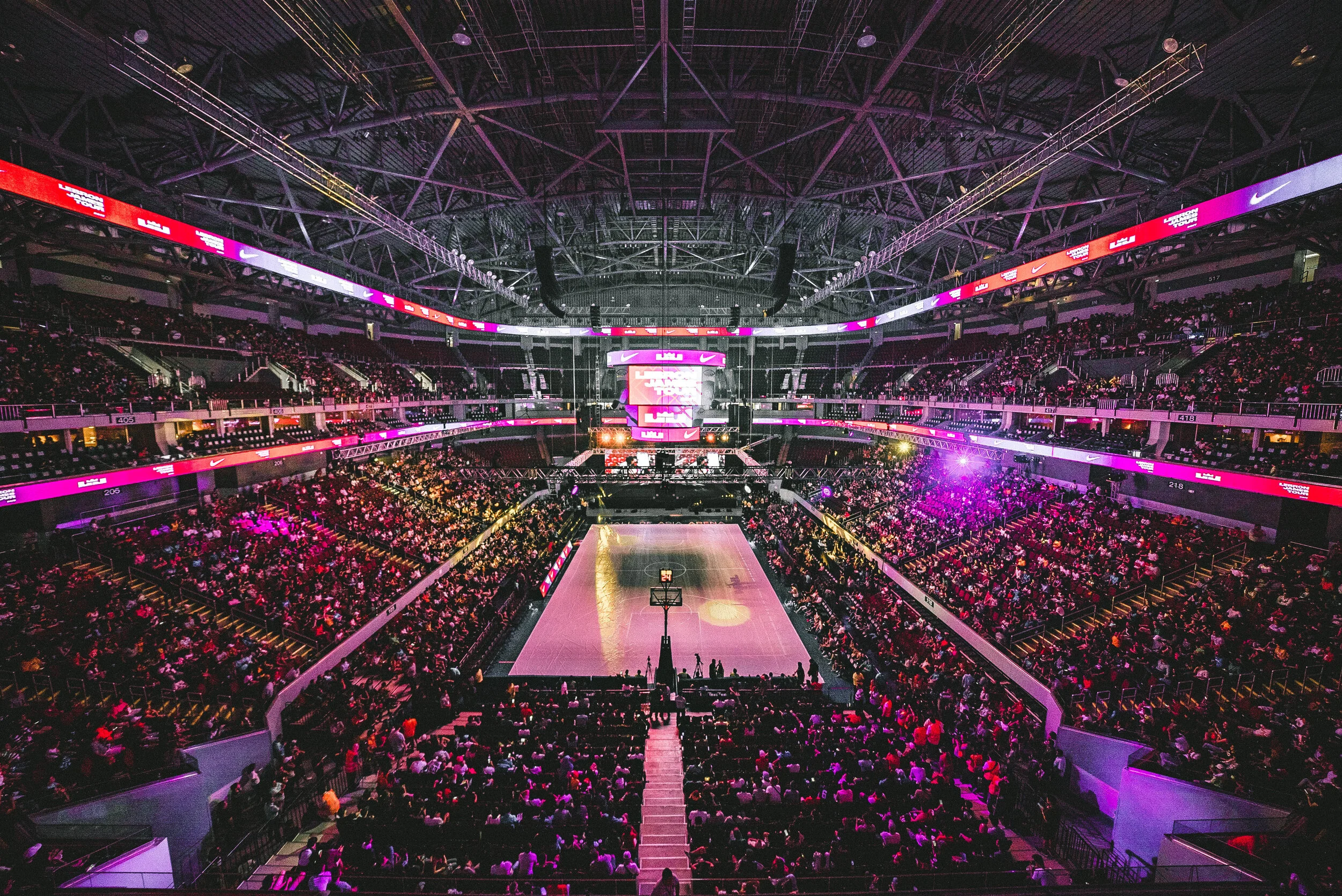

Ever since mid march, a vast majority of the United States has been in a quarantine due to the breakout of COVID-19. Regular life for all citizens has been halted for a certain period of time and many restaurants, bars, and other forms of entertainment, such as professional sports and casinos, have been put on hold. On March 11th, the National Basketball Association suspended their season after Rudy Gobert tested positive for coronavirus minutes before tip-off versus the Oklahoma Thunder. Following suit, the MLB suspended their spring training activities on March 12th along with the NHL who was in the later half of their season. According to estimates from the American Gaming Association, Americans gamble more than $150 billion dollars illegally on sports through bookies or offshore websites. (Ponseti/American Gaming Association) When these sports all got cancelled, these gamblers had to fuel their addiction and put their money into some place. This along with other factors such as free time from unemployment and stimulus checks from the federal government lead to a boom in retail trading in 2020.

A few weeks after all the major professional sports leagues suspended their seasons indefinitely, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act and it was signed into law by President Trump on March 27th, 2020. This allowed the government to send $1,200 to individuals with annual income under $75,000 and $2,400 to married couples filing taxes jointly who earn under $150,000, according to the IRS. (Fitzgerald) Software and data aggregation company Envestnet Yodlee did a study on how consumers spent their stimulus checks after receiving them, and stock trading was a top form of use for most income brackets. For instance, the study showed that households that make $35,000 to $75,000 annually had an increase in stock trading of 90% or higher the week after receiving their stimulus check (Fitzgerald) Even families that were in the higher income bracket of making $100,000 to $150,000 had an 82% increase in stock trading the week after receiving their stimulus checks.

Around two weeks ago, Charles Schwab released a report for their retail accounts which gave insight on how their amount of total accounts, new accounts, and day-trading volume has increased during their 2nd fiscal quarter of 2020. Jim Bianco, founder of Bianco Research L.L.C., a company specializing in macroeconomic analysis, shared in a tweet on July 17th insights which further reveal the significance of the report. The report showed that the amount of new accounts increased by 1.37 million users in that quarter alone, which was more than the previous 6 altogether. Another fascinating stat from this study showed that the amount of day traders rose to 1.6 million accounts, which was a 400% increase since the end of 2019.

This indicates that not only was there an exponential amount of retail traders joining brokers since the start of the COVID-19 pandemic, but that they were consistently making trades everyday.

With the studies done by Charles Schwab and Envestnet Yodlee showing the increase in U.S. retail trading accounts and volume, there has also been a catalyst within the social media world who has been making day-trading fun and entertaining for new users.

Dave Portnoy, founder of Barstool Sports has been livestreaming himself day trading since the start of quarantine under the alias “Davey Day Trader Global”, and has gained a large following through the financial community because of it. On Twitter, he streams during the market open and close on a typical weekday to his 1.7 million followers with an enthusiastic, naive approach to day-trading. His blind confidence has led him to interviews on Fox News Business and CNBC where he has discussed his gambling-like style of investing with the likes of Tucker Carlson and Fast Money host Jim Cramer. On June 9th, he felt that great about his investing skills that he claimed for the year 2020 that he has been a better trader than Warren Buffett. During one of his daily livestreams, he stated that he viewed Buffett as a “hall of fame trader, but as of right now I am a better trader than him. It’s no debate, I killed him. He’s dead.” Portnoy said this after Buffett stated that he sold his airline stocks when the sector was near a 52-week low. As of December 2019, “Berkshire Hathaway owned 42.5 million (10% stake) American shares, 58.9 million (9.2% stake) Delta shares, 51.3 million (10.1% stake) Southwest shares and 21.9 million (7.6% stake) United shares. The stocks are down 62.9%, 58.7%, 45.8% and 69.7%, respectively,” at the time they sold in early May 2020. (cnbc.com)

Although Portnoy did not get a direct response from Warren Buffett after calling him out for his financial performance in 2020, other big figures in the financial world have criticized the Barstool president for his antics. Peter Cecchini, former Senior Managing Director of Financial Service firm Cantor Fitzgerald, coined a new term for the outperforming bullish market “The Portnoy Top”. When speaking about Portnoy, he said he “is a new, more extreme (and in his case wealthier) version of the day traders of the late 1990s or the house-flippers of the mid-2000s. His attention-getting, wild style is emblematic of just how emotional and extreme equity markets are now. Even more important is the fact that this emotion can be translated to action with a click anytime and anywhere. It’s both impulsive and compulsive. His behavior really just explains everything. It doesn’t even matter if he’s serious or not.” (Cecchini) Although I personally don't feel like he is necessarily right about the market being at the top right now, he explains accurately what Portnoy is doing as he is leading an army of emotional traders who follow his lead and gamble their money on micro-cap stocks not based on due diligence but rather on speculation.

Therefore, there have been a few main variables that have led to the increase in retail trading in 2020. A global pandemic that has led to the shut down of professional sports, unemployment for non-essential workers, stimulus checks and entertainers entering the financial world have made the stock market reach peak insanity. A new era in the stock market is upon us as we have seen the S&P 500 reach a 52-week low of $218.26 in mid-march, and now it is miraculously trading at around $336.16, due to the increase of new buyers. As professional sports have now returned around the world and gambling is back, it will be interesting to see if the increase in retail traders will retain and if day-traders continue to consistently buy and sell in the market.

Works Cited:

Bianco, Jim. “Schwab Reported Yesterday...a Massive Increase in Retail.Total Accts (Blue)/New Accts(Orange) Surged in Q2. More New Accts in Q2 (1.37m) than the Prev 6 Qrts Combined!Daily Active Traders (or DARTs) Has Boomed to 1.6m (Day-Trading) Accts, 400% Increase from the End of 2019. Pic.twitter.com/297fZdIFKx.” Twitter, Twitter, 17 July 2020, twitter.com/biancoresearch/status/1284157903147077632.

Cecchini, Peter. “Stock Market Strategist Calls Dave Portnoy A Financial Idicator.” CD Media, 12 June 2020, creativedestructionmedia.com/news/markets/2020/06/12/check-in-with-cecchini-cecchinipeter/.

Fitzgerald, Maggie. “Many Americans Used Part of Their Coronavirus Stimulus Check to Trade Stocks.” CNBC, CNBC, 22 May 2020, www.cnbc.com/2020/05/21/many-americans-used-part-of-their-coronavirus-stimulus-check-to-trade-stocks.html.

Ponseti, Caroline. “97% Of Expected $10 Billion Wagered on March Madness to Be Bet Illegally.” American Gaming Association, 12 Mar. 2018, www.americangaming.org/new/97-of-expected-10-billion-wagered-on-march-madness-to-be-bet-illegally/.

Portnoy, Dave. “I'm Sure Warren Buffett Is a Great Guy but When It Comes to Stocks He's Washed up. I'm the Captain Now. #DDTG Pic.twitter.com/WqMR89c7kt.” Twitter, Twitter, 9 June 2020, twitter.com/stoolpresidente/status/1270350291653791747.