Oil Crash?

On Monday, April 20th, 2020 the economy was shocked by a historic oil price freefall. Panicked investors sold their oil positions, creating a ripple effect in stock and bond markets. To understand why financial markets reacted this way, we first have to understand the oil market and how investors trade this commodity.

Oil is traded in the financial markets in the form of futures contracts. These contracts are set at prices predetermined at a specified time in the future. This means that the buyer of a futures contract takes on the obligation of receiving the underlying asset at the date of the contract’s expiration. In contrast, the seller is taking on the responsibility to deliver the underlying asset at expiration. This means that companies and investors are able to buy and sell stakes in oil in advance. They speculate on the fluctuating prices of these contracts in order to buy/sell the barrel(s) of oil at a set price if you’re a company, or make money on a short term investment if you’re an investor. These contracts expire every month, which is when contract buyers (typically companies) are expected to settle on the price they bought in at, and take their oil.

What exactly happened on that Monday? Oil prices for the futures contracts set to expire on April 21st, fell to negative values. This means that oil producers would have had to pay their customers to take their oil. On one end, oil purchasing companies would love to be paid to obtain more oil, but they simply don’t need it. On the other end, since the everyday investor trades oil futures for speculative profits and doesn't actually obtain it, he or she doesn’t have room or even a permit to store said oil. The futures contracts for May got to a point where they were trading at negative $55 per barrel of WTI Crude Oil (benchmark oil for the U.S.).

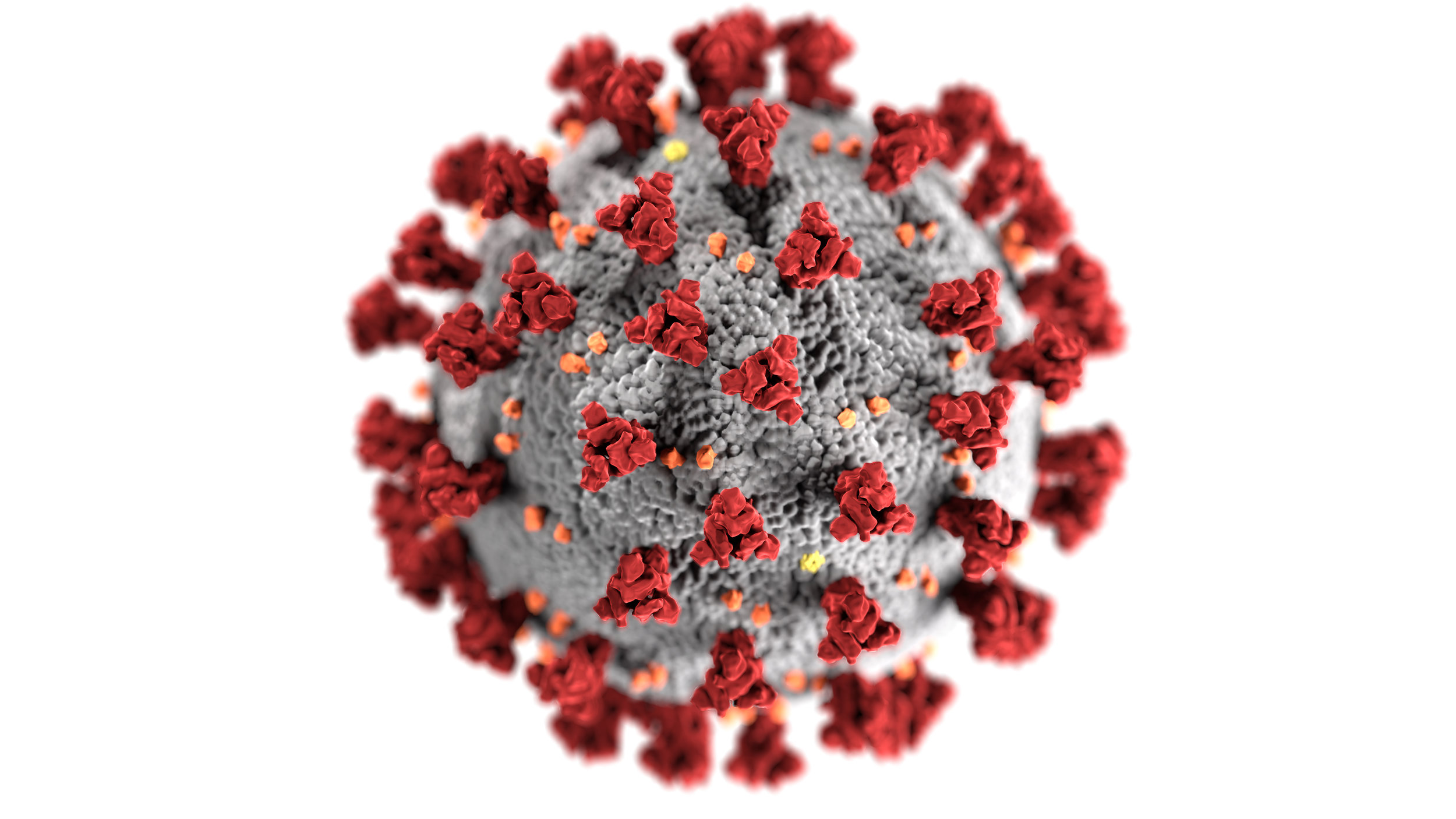

Since the beginning of the COVID-19 pandemic, demand for crude oil has declined dramatically. People aren’t driving or flying, making it tougher for oil companies to sell. Subsequently, producers are experiencing “storage squeezes,” where they have too much oil for their facilities. Investors and oil companies were also “rolling over” their futures contracts, meaning they were selling their May contracts that were about to expire, and buying future contracts at later expiration dates. By positioning in later contracts and selling off the earlier, “soon-to-expire” ones, it created a ripple effect where prices of oil futures fell sequentially with the time of expiration.

Due to the severe decline in demand, oil companies were forced to “shut in,” meaning they produced well below the available output. This typically only happens to offset a potential environmental disaster, like oil well leaks or oil drilling failures. However, in this case, it was to prevent oil producers from paying their customers more than they have to to take their oil.

Why can’t these oil companies just save the excess barrels of oil, you might ask? There is finite space to store oil on a global scale, and this space has been filling up rapidly. Oil producers cannot afford to create larger storage space for what is effectively a short term problem. Already at risk of going bankrupt, these oil companies are in deep enough financial trouble that it doesn’t make sense for them to stop production altogether. This would mean stopping employees from working and getting paid, on top of incurring fixed costs. Without employees, the firm stops generating revenue from production. Although this saves money since workers aren’t being paid, companies still incur fixed costs such as rent for facilities, taxes, interest payments and more. So, without any cash coming into the firm, fixed costs cannot be paid and the company would be forced to shut down. To help this, oil producing countries such as the United States, Saudi Arabia and Russia have reached a deal to cut oil production by a record 9.7 million barrels a day. This not only saves oil companies from shutting down by allowing them to remain operations, but it artificially raises the price of oil while slowing the rate of growth in oil reserves.

Still, there is no doubt that storage fields are overwhelmed by the supply shock, especially in Cushing, Oklahoma. According to a recent Goldman Sachs’ podcast episode for “Exchanges at Goldman,” this oil drop was a “technical idiosyncratic event” that hit Cushing the hardest. Nobody could have predicted the shock. Per Financial Times, Cushing is the largest delivery point for the U.S. benchmark crude oil. Therefore, since oil was held up, it was the first place to look for overcapacity issues. In mid April, before the crash, Cushing’s capacity was at 70%, with the rest closed for lease as companies feared they wouldn’t be able to sell their oil. This meant any last-minute storage buyers couldn’t go to the largest oil tank farm in the U.S. for storage space, unless they wanted to pay lease-holders to take their oil. Realization of this caused May contract holders to panic and sell in fear that storage space was only becoming more limited. This contributed to the decline in prices on April 20th.

All in all, it is nearly inevitable that some companies will go bankrupt in the coming months, or however long oil demand is suppressed. It is extremely unfortunate for jobs and output in the industry, as production has declined and oil isn’t selling. In the recent weeks, oil has partially recovered to positive levels, but futures contracts are not trading at the prices they were before the pandemic. Floating around $20/ barrel of crude, there is still a long way to go to climb back to 2019 levels of around $50/ barrel. As the U.S. government and Federal Reserve tap in to their balance sheets to mitigate the losses in the oil industry, we should use our American optimism to hope for a brighter future.

References

“Client Call: Market Volatility and Potential Economic Impacts.” Goldman Sachs, 1 Apr. 2020, www.goldmansachs.com/insights/podcasts/episodes/04-01-2020-john-waldron.html.

Duffy, C., & Disis, J. (2020, April 13). OPEC reaches deal to cut oil production by 9.7 million barrels per day. Retrieved from https://www.cnn.com/2020/04/12/energy/opec-deal-production-cut/index.html

“JPMorgan Reveals 3 Reasons the Oil Crash Won't Create Systemic Risk for Markets | Markets Insider.” Business Insider, Business Insider, markets.businessinsider.com/news/stocks/oil-price-crash-wont-create-systemic-risk-markets-jpmorgan-negative-2020-4-1029123016.

Kowalski. “Learn About the Basics of Trading Crude Oil Futures.” The Balance, The Balance, 24 Apr. 2020, www.thebalance.com/trading-crude-oil-futures-809351.

Meyer, Gregory. “Oil World Zeroes in on Cushing, Oklahoma.” Subscribe to Read | Financial Times, Financial Times, 24 Apr. 2020, www.ft.com/content/51d2f6a5-1a71-4c1c-b022-8768fdb72519.

Sabga, Patricia. “Why US Oil Prices Crashed and How It Will Affect You.” News | Al Jazeera, Al Jazeera, 21 Apr. 2020, www.aljazeera.com/ajimpact/oil-prices-crash-affect-200421134650761.html.