Partisan Politics and the Stock Market

Partisan politics have played a large role in the course of the stock market's history. With Presidents, Senators, and Congressmen trying to take credit for the highs and blaming the opposing party when something turns south. Policy changes directly affect the price of stocks since they can change the investor outlook on future profitability.

The stock market has had significant success in predicting the outcome of the U.S. Presidential Elections. Since the election of Herbert Hoover in 1928, to the election of Donald J. Trump in 2016, there have been 23 Presidential Elections and the stock market has only incorrectly predicted them 3 times. When the S&P 500 is higher during the 3 months leading up to the election, the current party in office normally retains power. However, if it is lower during the 3 months leading into the election, the current party is normally replaced by the opposing party. Since 1984, the stock market has successfully predicted every single one of the U.S. Presidential elections. Investors who are interested in how politics move markets, should be paying very close attention to the election over the next few months.

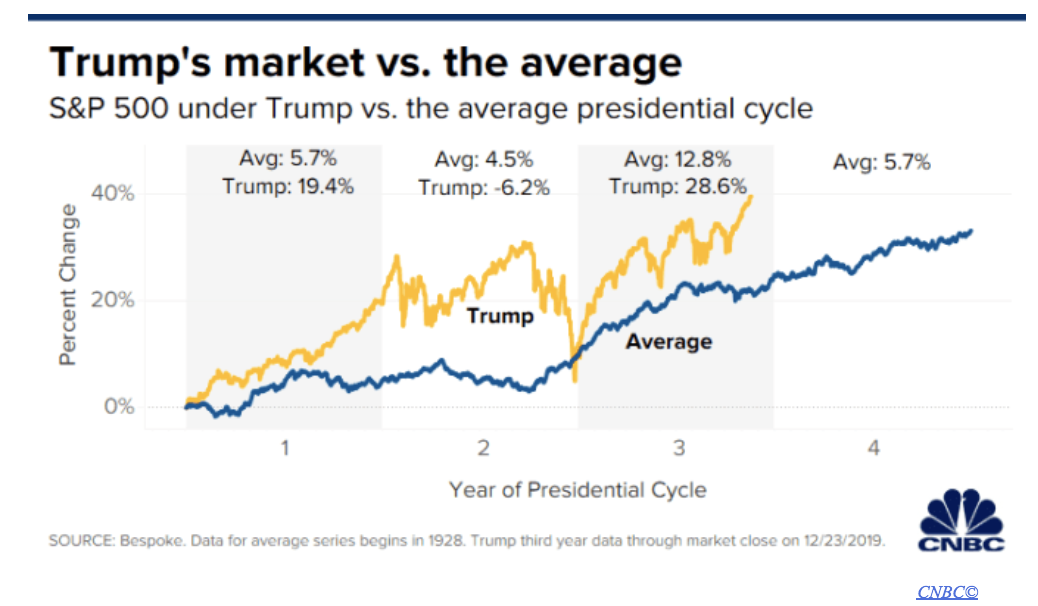

Before the coronavirus, the stock market was hitting all-time highs, and the Trump Administration’s S&P 500 average was far outweighing the normal average. Trump’s first-year average was more than triple that of past U.S. Presidents. Coming in with an average of 19.4% compared to that of 5.7%. While this may just be a single instance versus an average of many, it is still an impressive increase in the first year. During his third year as President, the market soared an astounding 28.6% compared to the third-year average of past Presidents at 12.8%. This isn’t the highest third-year average that the market has ever seen, as the Obama Administration saw a 32% increase as the economy rebounded from the 2008 recession. Both of these administrations saw incredible market returns while holding very different political viewpoints.

A study on politicized stock markets found more on partisan views affecting the stock market than was expected (Cookson). Over the past 30 years, partisan differences have affected beliefs across a multitude of issues (Cookson). After the 2016 Presidential Election, Trump has tweeted about the stock market more than 130 times and Investors from pro-Trump zip codes have tended to invest much more aggressively than those of pro-Clinton zip codes (Cookson). During the Covid-19 crisis, the stock market has seen the largest swings in volatility since the 1929 stock market crash (Cookson). Creating a largely unpredictable market. Republicans have been mostly optimistic during this time with a large amount of trading volume occurring amid the crisis (Cookson). During the Coronavirus pandemic, partisan differences have only heightened. There has been a sharp political divide on China and the role that they played in the virus which has created investor turmoil with many Chinese based companies (Cookson).

The talks about the 2020 Presidential Election and Trump vs. Biden have moved to the stock market. Republicans and Democrats alike are trying to decide how to manage their portfolios heading into November. Over the 2 year period post-election, the overall market goes up an average of 5.7% with a democratic win, and 8.3% with a Republican win. The data in this analysis goes back to 1798, so it outranges the data from the stock market predictions of elections. However, there is a difference in the market averages when Republicans hold both the House and Senate as opposed to Democrats. When Democrats hold both the House and Senate majorities, the average market return is an increase of 3.4%. On the contrary, when Republicans hold both majorities, the forward return on stocks is a striking 12.2%. Heading into November, these numbers carry a lot of weight for investors. If the stock market stays lower during the 3 months heading into the election, and the stock market successfully predicts a change of party holding the Presidency, there could be a period of underperformance in the stock market. On the contrary, If Republicans were to gain a foothold on the House and maintain the Senate majority, there could be a period of soaring performance.

Joe Biden is currently leading the election polls by 4 percentage points over Trump. He has claimed that with a Presidential win he would raise the U.S. Corporate tax rate from 21% to 28%. This is a very large increase that could scare investors, especially during this crazy economical time period. Gabriella Santos of JPMorgan Asset Management stated that the “election is starting to matter a little bit more for daily market performance.” If a Democratic sweep was to occur, the economy would see higher corporate tax rates and larger sector implications, creating conversations surrounding future earnings expectations.

Only time will tell whether or not the stock market will accurately predict the 2020 Presidential Election. Leading into 2020, the S&P 500 average was much higher than anticipated, and normally the strongest years the market has under a President are their 3rd and 4th. With the strike of the Coronavirus, it could be possible that the stock market is not in the position to predict the election as it has in the past. The circumstances surrounding this election are unique. Coming off what was considered a shocking win by Trump in 2016, successful corporate tax reform allowing corporations to retain more revenue in 2017, and the Coronavirus in 2020, it will be interesting to see whether or not the stock market can successfully predict an election for the 10th time straight.

Works Cited:

Cookson, J., Engelberg, J., & Mullins, W. (2020, June 07). Does Partisanship Shape Investor Beliefs? Evidence from the COVID-19 Pandemic. Retrieved July 04, 2020.