M&A Deals Keep Rolling

2018 is on near-record pace for annual transaction value, with over $2.5 trillion of mergers announced in the first six months, according to Thomson Reuters. PitchBook (a private capital research company owned by Morningstar) reports that these high values and volumes are driven by a slew of factors: private equity firms are collecting add-on investments at record pace, the healthcare and financial services industries are both consolidating, and North America and European median deal values are at decade highs. What’s more, PitchBook predicts robust H2 activity, close to the record year of 2015, due primarily to higher deal values amidst declining deal counts. With multiple mega-mergers announced for the second half of the year, the M&A cycle continues to exhibit strength. So, as acquirers pay more and more for their targets, it begs the question of how they are still achieving returns over cost of capital. With this in mind, let’s look at what factors affect M&A return, and how companies manage these investments.

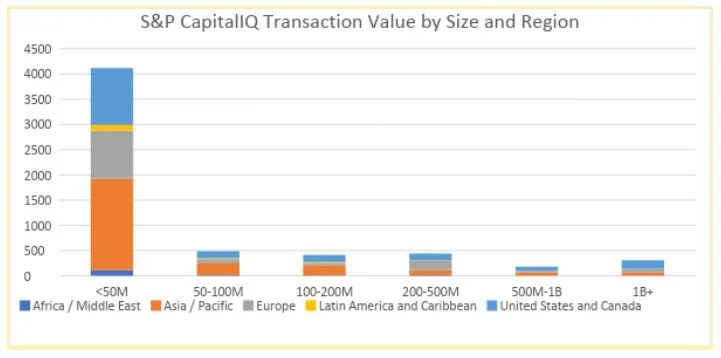

First, let’s examine deal size. When people hear “merger”, they often think of the multi-billion dollar deals, the ones that splash across every financial news site. Last year, it was CVS-Aetna, Amazon-Whole Foods, and Microsoft-LinkedIn, among others. This year, we’ve seen AT&T-Time Warner, the very public fight between Comcast and Disney over Sky, and 34 other deals over $10 billion. However, this is nowhere near the normal M&A transaction. Starting in 2015, there have been over 50,000 mergers and acquisitions announced annually (HBR). Since these handful of mega-deals consist of about 25-40% of the total transaction value annually, we can mathematically see that the average deal value is well under $100M. Data from CapitalIQ confirms that the first 6 months of 2018 have followed this pattern, shown below.

Now, due to the high visibility of these multi-billion-dollar deals, failures often stick in the public consciousness. Time Warner-AOL is a fantastic example, as is Hewlett Packard-Compaq. However, academic research has found that size is more of a proxy than a direct determinant of return (Bruner). Large deals tend to be consummated with stock, and these stock deals tend to have poor returns. Large cash deals have positive returns, and small cash deals have significantly positive returns.

There are a variety of reasons that contribute to this. The first is that small companies can be much easier to integrate into a large company, as there are simply fewer people and resources to “fold in”, whether it’s at the strategic, functional, or IT-level. This means that small deals should have a higher probability of success. Another is that managers have incentives to pay in stock when they believe their stock is overvalued, thus making the purchase relatively cheaper. As the stock price becomes correctly priced, this can give a merger the appearance of failure regardless of its actual return.

Lastly, these large deals often have a significant portion of value attributed to “synergies”, which is a catch-all term. Some synergies are easily realized, like closing redundant distribution centers or consolidating C-suites (i.e. NewCo only needs one CFO, one CIO, etc. from the merging companies). Others are much more difficult to realize, like “selling old products through new distribution channels” or “selling new products to new markets”. It’s not that these aren’t possible; it’s that the value ascribed to them can be somewhat aspirational. The larger the “aspirational synergies”, the less likely a deal is to be successful. Oftentimes, these mega-deals have large aspirational synergies, and this causes a failure to achieve strong returns.

Nowadays, M&A is also increasingly focused on IT integration, because business practices are increasingly technologically driven. So, when a company acquires another, it is crucial to integrate the acquisition’s data sources and employees into the acquirer’s ERP and user-base. [Full disclosure: I work for SAP on the Private Equity and M&A Teams and am exposed frequently to IT integrations in the case of acquisitions.] What’s more, target corporations typically have worse IT systems than their acquirers, by virtue of having fewer resources to expend on systems, so acquirers will oftentimes have to “rip and replace” systems during integration. A 2013 study found that investors often fear the costs of this, and (on average) discount the transaction, reducing the acquirer’s stock price. However, they also found that experienced acquirers do not face similar discounting, as markets typically believe their stronger integration skills will minimize or eliminate any disruption. This holds true for both corporations and private equity investors.

Finally, another major determinant of M&A returns is the similarity between buyer and seller, which includes a few different factors. When we think about similarity, we first look to the type of business. Is this a horizontal merger, where, simply put, a company buys another that has mostly overlapping business practices? We can think of this as one logging company buying another logging company. Or is it a vertical merger, in which a company buys a company somewhere higher or lower on the supply chain? This would be like a logging company buying a furniture manufacturer or a forestry trucking company. Horizontal mergers are typically viewed more favorably than vertical, and both of these are viewed more favorably than unrelated companies merging (i.e. a logging company buying an apparel company). Next, investors look for geographic similarity, particularly in cases of acquisitions in different countries, like Fiat-Chrysler. Geography not only shows investors the potential for time zone difficulties and separation of supervising management from employees, but also any possible cultural differences. This last is the third type of similarity and can be surprisingly difficult to overcome.

Mergers and acquisitions are not silver bullets to business performance, but they are by no means a surefire loss. Stakeholders in acquiring companies must evaluate each M&A announcement like they would any other corporate action or investment, as each comes with its own unique challenges and opportunities.

Works Cited

Baker, Liana B. “Global M&A Hits Historic High with Media Deal Wave.” Reuters, Thomson Reuters, 29 June 2018, www.reuters.com/article/us-global-m-a-q2/global-ma-hits-historic-high-with-media-deal-wave-idUSKBN1JO3CY.

Bruner, Robert F. Deals from Hell : M&A Lessons That Rise Above the Ashes. Wiley., 2005.

Gomes-Casseres, Benjamin. “What the Big Mergers of 2017 Tell Us About 2018.” Harvard Business Review, 19 Mar. 2018, hbr.org/2017/12/what-the-big-mergers-of-2017-tell-us-about-2018.

Mortal, Sandra, and Michael J. Schill. “The Post-Acquisition Returns of Stock Deals: Evidence of the Pervasiveness of the Asset Growth Effect | Journal of Financial and Quantitative Analysis.” Cambridge Core, Cambridge University Press, 12 Aug. 2015, www.cambridge.org/core/journals/journal-of-financial-and-quantitative-analysis/article/postacquisition-returns-of-stock-deals-evidence-of-the-pervasiveness-of-the-asset-growth-effect/68D4383F00A213F47CFCCA83E0865C59.

PitchBook. “10 Charts Illustrating M&A Activity in 2Q 2018.” PitchBook, Morningstar, 28 Aug. 2018, pitchbook.com/news/articles/10-charts-illustrating-ma-activity-in-2q-2018.

PitchBook. “2017 Annual M&A Report.” PitchBook, Morningstar, 24 Jan. 2018, pitchbook.com/news/reports/2017-annual-ma-report.

PitchBook. “2Q 2018 M&A Report.” PitchBook, Morningstar, 8 Aug. 2018, pitchbook.com/news/reports/2q-2018-ma-report.

Tanriverdi, Huseyin, and Vahap Bulent Uysal. “When IT Capabilities Are Not Scale-Free in Merger and Acquisition Integrations: How Do Capital Markets React to IT Capability Asymmetries between Acquirer and Target?” European Journal of Information Systems , Taylor & Francis Online, 19 Dec. 2017, www.tandfonline.com/doi/abs/10.1057/ejis.2013.22.