Is Accounting Profit Enough?

Everyone knows what profit is: money generated minus all associated costs equals profits. This was so at your childhood lemonade stand, and, with a few adjustments for depreciation, taxes, and goodwill impairment, it holds true for your multinational corporations today. However, what we’re discussing is purely accounting, just the on-the-books profit the company generated. A more illustrative figure is Economic Profit or Economic Value Added (EVA), which considers the cost of capital for a firm. Investors, by assessing this capital charge, are examining whether the firm returned any profits, given its theoretical opportunity costs. In this way, they can look past the accounting, and see what value their invested equity actually returned.

For the purposes of this discussion, we’ll define Economic Profit in two different ways. The first is Net Operating Profit After Taxes (NOPAT) minus Capital Invested multiplied by the blended cost of capital (Capital * WACC). The second focuses on Common Equity, and uses Invested Equity multiplied by Return on Equity minus Cost of Equity [ Equity * (ROE – Ke) ]. As you can see, either way, an Accounting Profit can quite easily turn into an Economic Loss. What this means essentially is that for the entire business or across all of the projects in a given year, management performance and project selection ability can be assessed. If an Economic Loss occurs despite an Accounting Profit, management performance did not deliver value above the cost of capital to their shareholders. Plainly, it means that investors would have wanted to invest elsewhere.

However, there are two important caveats. The first is that Economic Profit is not predictive. Consulting firms may argue that a history of creating Economic Profit raises the likelihood of future positive Economic Profit, but this uses the same logic behind buying stocks that have returned well. Past positive returns don’t necessarily predict long-term positive returns. Additionally, firms in major reorganizations or periods of high capital investment will also see an unrepresentative Economic Profit/Loss. The second caveat is that it is a better measure for capital-intensive companies. High-tech firms, or knowledge worker-heavy industries, surely create Economic Losses in many cases, but the actual calculation will rarely show this. As always, qualitative analysis must be brought to these figures.

Academia has also recognized there is some additional value of Economic Profit over the general accounting figures. Holian & Rez found that firm and industry characteristics explain far more of the variation in EVA than in ROA (50% vs 17%). Dr. G. Bennett Stewart, among others, believes that greater focus on Economic Profit would align managers more with shareholders, rather than their ever-increasing focus on earnings management and meeting analysts’ quarterly projections. However, there are, of course, some papers refuting these benefits, especially as value becomes decoupled from tangible assets.

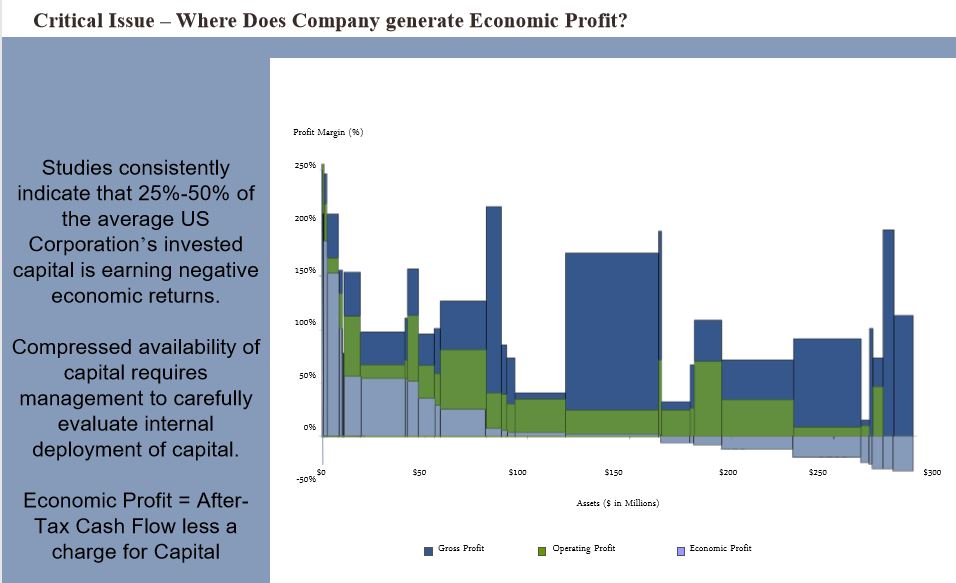

Now, note that I mentioned before how this kind of analysis can be used on a project-level basis. It can also be used at the business unit-level as well, which opens an interesting conversation about what corporations actually do to add value. I was first exposed to the chart below in my summer course in grad school this past June, sourced by my professor from Business Intelligence Associates, LLC. I find it to be quite fascinating, so let’s take a look.

We see that the company depicted has deployed $300 million in assets, have placed their business units by amount of assets on the X-axis, and have graphed the ROIs for the business units on the Y-axis. The business units’ Economic Profits decrease from left to right. The blue portion of the bars is simply Revenue minus Cost of Goods Sold (COGS). The green portion is Operating Profit, which subtracts Sales, General, and Administrative costs, etc. Most importantly, the gray portion is Economic Profit.

Let’s start in the middle of the chart. A business unit deploying $50 million in assets, or one-sixth of their total, is producing little to no economic profit. However, its Gross ROI is very high, and the Operating ROI is attractive as well. Meanwhile, some of the business units to the left, with far higher Economic ROIs, have higher Economic Profits in dollars than this unit, despite being less capital-intensive. As the sidebar states, we then see to the right where about 45% of the assets have a negative Economic Profit, some considerably so.

My professor used the example of a financial institution. He joked that the M&A guys (like himself) will pat each other on the back for securing a ten-million-dollar fee for some transaction, and then one guy at a credit swap desk will use that fee to make more economic profit in one swap than they will in a year. What it illustrates though is that Economic Profit goes deeper than looking at large, flashy business units, or even flashy companies. It uses a company’s cost of capital to assess whether invested capital was deployed effectively, and, with the earlier caveats in mind, whether any real value was created. This is what should be most important to the shareholders in a company, not necessarily the optics of profitability, but the economic value added. However, due to ease of calculation and the slightly more complex conceptuality, accounting profits still rule the boardrooms and analyst calls, and likely will continue to do so in the future.

Sources

Bodie, Zvi, et al. Essentials of Investments. Vol. 9, McGraw-Hill Irwin, 2013.

“Economic Profit.” Investing Answers Building and Protecting Your Wealth through Education Publisher of The Next Banks That Could Fail, www.investinganswers.com/financial-dictionary/financial-statement-analysis/economic-profit-2927.

“Economic Profit Growth.” Marakon, www.marakon.com/insights/economic-profit-growth/.

Holian, Matthew J. & A. Rez. “Firm versus Industry Effects in Accounting and Economic Profit Data.” Applied Economics Letters, San Jose State University, 1 Jan. 2011. http://scholarworks.sjsu.edu/cgi/viewcontent.cgi?article=1037&=&context=econ_pub&=&sei-redir=1&referer=https%253A%252F%252Fscholar.google.com%252Fscholar%253Fstart%253D10%2526q%253Deconomic%252Bprofit%2526hl%253Den%2526as_sdt%253D0%252C39#search=%22economic%20profit%22

Stewart, G. Bennett. “HOW TO FIX ACCOUNTING-MEASURE AND REPORT ECONOMIC PROFIT.” Online Wiley, Wiley/Blackwell, 11 Apr. 2005, onlinelibrary.wiley.com/doi/full/10.1111/j.1745-6622.2003.tb00461.x.