BREXIT: Stay or Leave? An Economic Analysis Part 2

This is the second part of a two-part piece on Brexit: what it is, and what it means for the UK. This part will focus primarily on the economic ramifications of Brexit, and how exactly the increased strain on trade will drastically hurt the UK economy. While there are many causes to the economic decline post-Brexit, including lack of foreign investment and decline in labor productivity, this piece will focus on what is believed to be the largest contributor: trade. EU trade increases competition as it brings more competitors into the UK market, increases UK companies’ profits as new markets are made available, and increases UK specialization in areas of comparative advantage. In 1973, trade with the EU comprised about 25% of all UK trade. (Van Reenen, 2016) In 2014, nearly half (49%) of total UK trade was with the EU (ONS Balance of Payments, 2018). Table 1 demonstrates this increase in trade over that 40-year period. According to Crafts (2016), the joining of the EU lowered the overall cost of trade for the UK by limiting tariffs and nontariff barriers. Crafts suggests that overall GDP was about 10% higher due to membership in the EU. If the UK exits the EU, it would forego all tariff benefits and other nontariff benefits to the UK economy.

Some of those with the desire to leave suggest that the economic benefits due to trade are nullified by the membership fee the UK pays to the EU. According to the Office for National Statistics, this membership fee is about £19 Billion a year. However, these fears are not backed by evidence. This £19B figure does not include a £5B rebate, £4.4B reimbursement to the UK public sector, and £1.2B reimbursement to the private sector. In all, the net payment is roughly £8B pounds—0.4% of UK GDP, about 38p/person/day, an all but negligible cost. This is not to say that there wouldn’t be any net benefit from saving this cost—but Brexit does not guarantee that the UK would not pay any costs. If they remain in the single market, the UK only saves about 17% of their current payments, based on what Norway pays (House of Commons Library 2013).

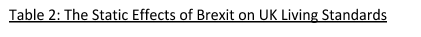

Table 2 outlines how static changes in trade will affect the living standards of UK citizens, factoring negative trade effects and fiscal benefits of saving the membership fee (measured in income per capita). Unilateral liberalization assumes that the UK will not place tariffs on imported goods. With a soft Brexit, income levels fall by 1.28%, due to trade problems caused by a lack of participation in EU trade benefits. If the UK radically liberalized their tariffs on imports from non-EU countries, the effect of Brexit would fall by about .3%. With a hard Brexit, the loss would be far greater, as all trade benefits would be lost. Static changes do not factor in the loss of competition and productivity that follows from a decrease in trade.

This table does not factor in dynamic changes due to competition and productivity as increased by trade. Trade increases competition by introducing foreign competitors into the domestic market. Competition, when kept at the appropriate level, increases innovation which in turn improves productivity. Economist James Feyrer (2009) has concluded that there is a direct relation between the amount of trade a country participates in and the relative income of its citizens. He finds that a 1 percent decline in trade reduces income per capita by between .50 and .75 percent. Since roughly half of UK trade is with the EU, a hard Brexit would lead to a decline in UK incomes by anywhere from 6 to 9 percent.

These costs are not negligible, and are only one issue that would arise from Brexit. A decline in foreign investment, the effects on labor productivity and innovation as a result of a decline in immigration, and a likely devaluation of the pound as a result of Brexit will also negatively affect the UK economy, reducing GDP and income per capita. It is for this reason that, on economic grounds, Brexit has the capacity to cause substantial economic problems for the UK. If the UK wishes to minimize these costs, and make Brexit a purely political move, they are best off remaining a part of the customs union and the single market. But this is unlikely because many Brexiteers who desire stricter immigration laws and greater control given to Parliament. In any case, the British exit made in March 2019 will have massive ramifications not only for Britain, but for the entire world.

Works Cited

Crafts, N. (2016). The Impact of EU Membership on UK Economic Performance. The Political Quarterly, 87(2), pp.262-268.

Feyrer, James. 2009. “Trade and Income: Exploiting Time Series in Geography.” Working Paper no. 14910. Cambridge, Mass.: National Bureau of Economic Research.

Griffiths, Alan and Stuart Wall. 2012. “The UK and the EU: The Costs and Benefits of the Single Market—BREXIT.” Applied Economics. Vol. 12.

House of Commons Library. 2013. “Leaving the EU.” Research Paper no. 13/42.

London.

Ons.gov.uk. (2017). The UK contribution to the EU budget - Office for National Statistics. [online] Available at: https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/articles/theukcontributiontotheeubudget/2017-10-31 [Accessed 10 Oct. 2018].

Ons.gov.uk. (2018). Balance of payments - Office for National Statistics. [online] Available at: https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/datasets/balanceofpaymentsstatisticalbulletintables [Accessed 10 Oct. 2018].

Van Rennen, J. (2016). ‘Brexit’s long-run effects on the UK economy’, Brookings Papers Conference, pp. 367-380.